S P 500

S&P 500 (S&P 500 Index) quote, chart, technical analysis, and historical prices. Data tables on Barchart follow a familiar format to view and access extensive information for the symbols in the table. Pages are initially sorted in a specific order (depending on the data presented). You can re-sort the page by clicking on any of the. About S&P 500 Index The S&P 500® is widely regarded as the best single gauge of large-cap U.S. Equities and serves as the foundation for a wide range of investment products.

The content provided on the website includes general news and publications, our personal analysis and opinions, and contents provided by third parties, which are intended for educational and research purposes only. It does not constitute, and should not be read as, any recommendation or advice to take any action whatsoever, including to make any investment or buy any product. When making any financial decision, you should perform your own due diligence checks, apply your own discretion and consult your competent advisors. The content of the website is not personally directed to you, and we does not take into account your financial situation or needs.The information contained in this website is not necessarily provided in real-time nor is it necessarily accurate. Prices provided herein may be provided by market makers and not by exchanges.

Any trading or other financial decision you make shall be at your full responsibility, and you must not rely on any information provided through the website. FX Empire does not provide any warranty regarding any of the information contained in the website, and shall bear no responsibility for any trading losses you might incur as a result of using any information contained in the website. The website may include advertisements and other promotional contents, and FX Empire may receive compensation from third parties in connection with the content. FX Empire does not endorse any third party or recommends using any third party's services, and does not assume responsibility for your use of any such third party's website or services.

FX Empire and its employees, officers, subsidiaries and associates, are not liable nor shall they be held liable for any loss or damage resulting from your use of the website or reliance on the information provided on this website. This website includes information about cryptocurrencies, contracts for difference (CFDs) and other financial instruments, and about brokers, exchanges and other entities trading in such instruments. Both cryptocurrencies and CFDs are complex instruments and come with a high risk of losing money.

You should carefully consider whether you understand how these instruments work and whether you can afford to take the high risk of losing your money. FX Empire encourages you to perform your own research before making any investment decision, and to avoid investing in any financial instrument which you do not fully understand how it works and what are the risks involved.

How It Works The S&P 500 tracks the of the companies in its index. Market cap is the total value of all a company has issued. It's calculated by multiplying the number of shares issued by the. A company that has a market cap of $100 billion receives 10 times the representation as a company whose market cap is $10 billion.

The total market cap of the S&P 500 is $23.5 trillion. It captures 80 percent of the market cap of the stock market. The index is weighted by a. It only measures the shares available to the public. It does not count those held by control groups, other companies, or government agencies. A each of the index's 500 corporations based on their liquidity, size, and industry.

It rebalances the index quarterly, in March, June, September, and December. To qualify for the index, a company must be in the United States and have a market cap of at least $6.1 billion. The S&P 500 includes. The stock must be listed on the, Investors Exchange,.

It cannot be over-the-counter or listed on. In 2017, the, with a weighted market cap, in the S&P 500 were Apple; Microsoft; Amazon; Berkshire Hathaway B; Facebook; JP Morgan Chase; Johnson & Johnson; Exxon Mobil; Alphabet C, formerly Google; and Alphabet A. The makeup of the S&P 500 industries reflects that of the economy.

According to the, the 2017 S&P 500 sector breakdown was:. Information Technology: 24.9 percent. Financials: 14.7 percent. Health Care: 13.7 percent. Consumer Discretionary: 12.7 percent. Industrials: 10.2 percent.

Consumer Staples: 7.7 percent. Energy: 5.7 percent. Utilities: 2.9 percent. Materials: 2.9 percent. Real Estate: 2.8 percent.

Telecom Services: 1.9 percent. How the S&P 500 Is Different from Other Stock Market Indices The S&P 500 has more than the. The Dow tracks the share price of 30 companies that best represent their industries. Its market capitalization accounts for almost one-quarter of the U.S. Stock market. The Dow is the most quoted market indicator in the world.

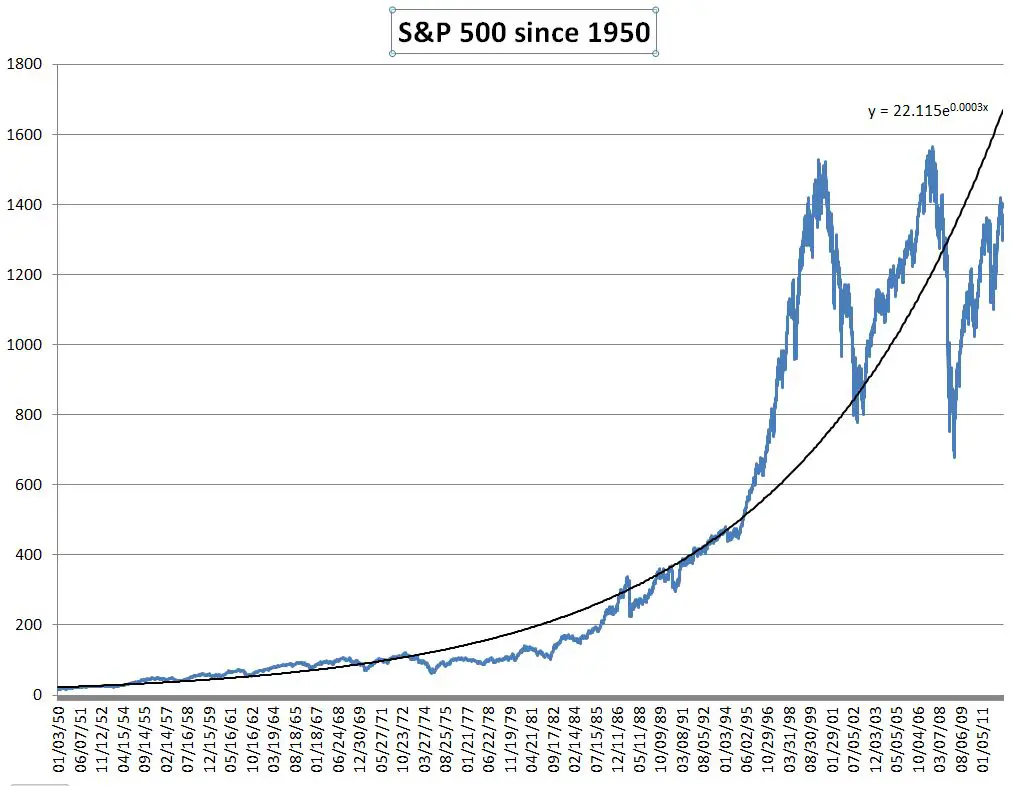

The S&P 500 has fewer technology-related stocks than the NASDAQ. The NASDAQ also includes the stocks of companies that are privately-owned. Despite these differences, all these stock indices tend to move together. If you focus on one, you will understand how well the stock market is doing. In other words, you don't have to follow all three. Milestones Date Close Event January 3, 1950 16.66 Record closing low. June 4, 1968 100.38 1st time above 100 October 19, 1987 224.84 largest% loss (20.5%) March 24, 1995 500.97 1st close above 500 February 2, 1998 1,001.27 1st close above 1,000 October 9, 2007 1,565.15 Highest close before financial crisis October 13, 2008 1,003.35 Largest% gain of 11.6%.

March 28, 2013 1,569.19 New record high August 26, 2014 2,000.02 1st close above 2,000 September 21,2018 2,929.67 Record closing high October 3, 2018 2,937.06 Highest intra-day (Source: Yahoo Finance.) History and Ownership The, by Standard & Poor. McGraw-Hill acquired it in 1966. The S&P Dow Jones Indices owns it now. That is a joint venture between McGraw Hill Financial, CME Group, and News Corp, the owner of Dow Jones.

The S&P Dow Jones Indices publishes over 1 million indices. How to Use the S&P 500 to Make Money Although you can't invest in the S&P, you can mimic its performance with an. You could also buy shares of stocks that are in the S&P 500. Be sure to weight them in your portfolio according to the market cap, as the S&P does.

S P 500 2018 Return

You should use the S&P 500 as a of how well the U.S. Economy is doing. If investors are confident in the economy, they will buy stocks. Some experts believe the stock market can predict what the savviest investors think the economy will do in about six months. Besides following the S&P 500, you should also follow the. When stock prices go up, bond prices go down. There are many different.

They include,. Bonds provide some of the that keeps the U.S. Economy lubricated. Their most important effect is on mortgage. To help you follow the bond market, also rates bonds. Since the S&P 500 only measures U.S. Stocks, you should also monitor foreign markets.

That includes like and India. It's also good to keep 10 percent of your investments in, like. They tend to hold value longer when stock prices drop.